40+ how many years tax returns for mortgage

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Wage Tax Statement 1098.

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

You can make a 10 down.

. File your taxes stress-free online with TaxAct. Web Most lenders do require you to provide tax returns for conventional loans. Web SUBSCRIBE AND TURN NOTIFICATIONS TO SEE NEW VIDEOS.

Calculate your mortgage payment. Its possible to find an FHA lender willing to approve a. DividendsInterest Miscellaneous Income Government Payments.

A FICO score of at least 580. USDA and VA loans wont require a down payment but conventional and FHA loans do. Sponsored Over 90 million taxes filed with TaxAct.

Sponsored Compare Best Mortgage Lenders 2023. You might need to provide. Estimate Your Monthly Payment Today.

Sponsored Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. If you own a business the lender will need the most recent two years of personal tax returns and any business returns you filed for your company for example. Web The way mortgage lenders verify federal income tax returns is by requesting income tax return transcripts from the IRS through the IRS 4506T form.

Web You can cut out the tax returns and estimated income by preparing your bank statements and showing how much you truly make. Sponsored Get an Affordable Mortgage Loan with Award-Winning Client Service. Keep records for 3 years.

Alternatively borrowers can amend. Web To get approved youll need. For example California generally has four years to audit a state income tax.

Web Income requirements for a mortgage. Web In almost all cases you can shred or throw away any documents such as W-2s 1099s or other forms or receipts three years after you file your tax return. Web Down payment size.

Apply Online Get Pre-Approved Today. Start basic federal filing for free. Web interest paid on their mortgage loan each year.

Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator. While this is certainly the case with the majority of mortgage lenders there. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Choose The Loan That Suits You. Another episode in the My Not So Crazy Mortgage series. Web Period of Limitations that apply to income tax returns Keep records for 3 years if situations 4 5 and 6 below do not apply to you.

Web Be prepared to include at least two years of tax returns and W2s with your paperwork for buying a house which will further support your income history. Web This video explains when you need tax returns for getting a mortgage loan. The Predatory Lending Scheme.

Tax credits can be taken at the time the borrowers ile. Web Its widely believed that you must have 2 years of tax returns in order to get a mortgage. They will require you provide all pages from the past two years plus IRS form 4506 T.

Web In addition since a mortgage commits to years of payments they want to determine your ability to repay your mortgage without falling behind or defaulting. Get All The Info You Need To Choose a Mortgage Loan. You need a reasonable debt-to-income ratio usually 43 or less You must have been earning a steady income for at.

Web HUD 40001 instructs the lender The Mortgagee must obtain complete individual federal income tax returns for the most recent two years including all. Mortgage InterestStudent Loan InterestTuition Statements 1099. A debt-to-income ratio below 50 percent.

Web 30-year mortgage rates. Sponsored More Veterans Than Ever are Buying with 0 Down. Web Lenders will check your tax returns from the last two to three years to verify the income you reported and the deductions you claimed.

A 35 down payment. Filing your taxes just became easier. Its possible to buy with as little as 3 down or 35.

Ebeqppubuj0aem

Canadian Mortgage Professional Cmp Issue 4 12 By Key Media Issuu

Do You See The Market Homebridge Financial Services

What Do Mortgage Lenders Look For On Your Tax Returns Better Mortgage

Peddinghaus Steel Fabricators Review Spring 2009 By Peddinghaus Corporation Issuu

How To Get A Mortgage When You Re Self Employed Freeagent

Every Landlord S Tax Deduction Guide Legal Book Nolo

6 Ways To Get Approved For A Mortgage Without Tax Returns In 2023

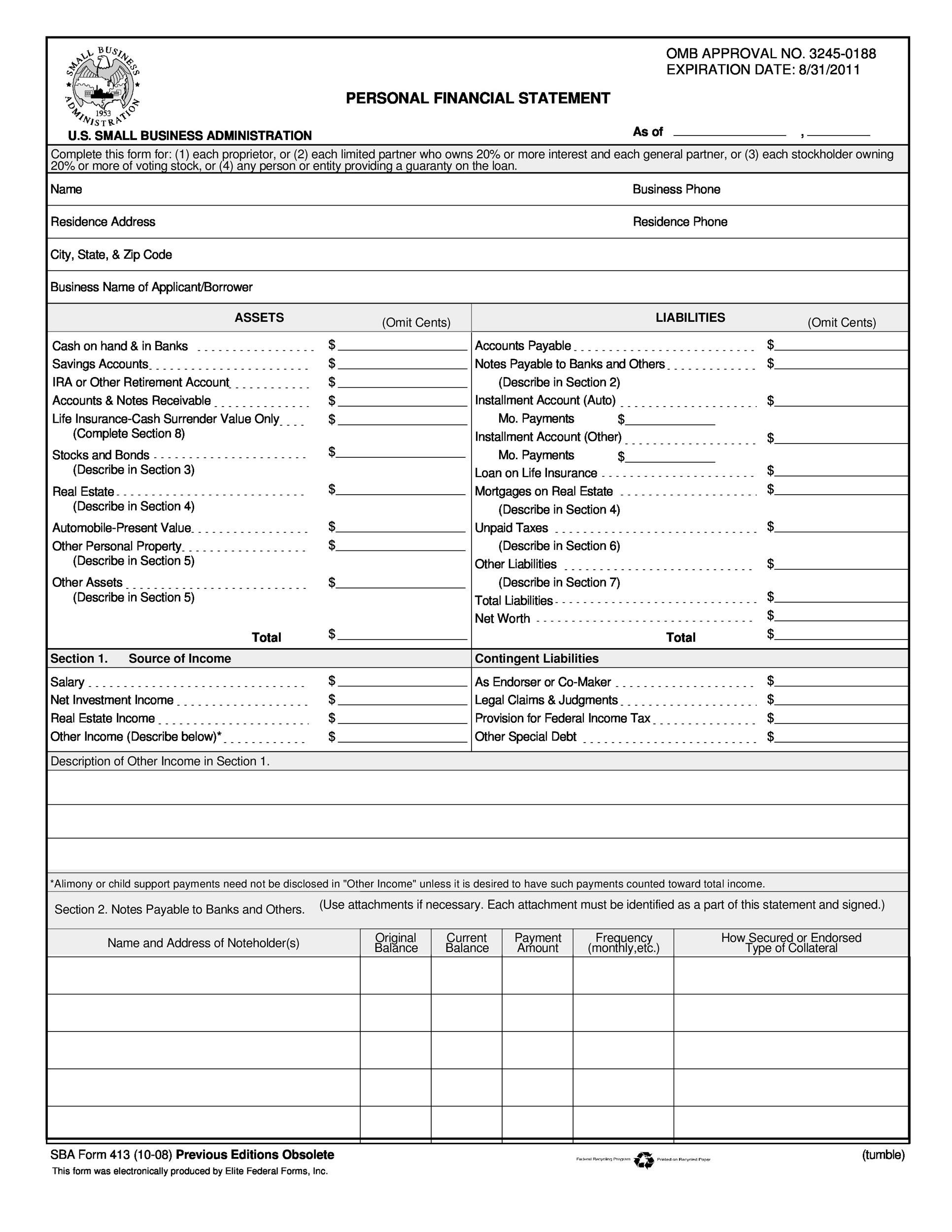

40 Personal Financial Statement Templates Forms ᐅ Templatelab

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

How Much Mortgage Can I Afford Comparewise

2022 Outlook Q A Crypto Inflation And Energy Transition Vaneck Rest Of Asia

1 Year Tax Return Mortgage 1 Year Tax Return Self Employed Mortgage

Rick Rucker Branch Manager Gold Star Mortgage Financial Group Linkedin

Consumer Bankruptcies Foreclosures Delinquencies And Collections Free Money Still Doing The Job Wolf Street

Filing Last Minute Taxes How To Prepare Smith Patrick Cpas

Derek Ketcho Cfp Financial Planner Cahill Financial Advisors Inc Linkedin